Second quarter 2018 revenue of $391.0 million

Adjusted EBITDA per credit agreement of $45.1 million

Adjusted earnings per diluted share of $0.28

Reaffirms Full Year 2018 Guidance

EAGAN, Minn., August 9, 2018 — ConvergeOne Holdings, Inc. (NASDAQ: CVON) (“ConvergeOne” or the “Company”), a leading global IT services provider of collaboration and technology solutions, today announced financial results for the second quarter ended June 30, 2018.

Second Quarter 2018 Highlights:

- Total revenue of $391.0 million, an increase of 104.4% year-over-year.

- Services revenue of $193.8 million, accounting for 49.6% of total revenue.

- Collaboration revenue of $257.2 million, accounting for 65.8% of total revenue.

- GAAP net loss of $7.5 million. GAAP net loss to common shareholders of $6.0 million, including the presentation effect of $(1.4) million of earnout consideration related to compensation expense. (1)

- Adjusted EBITDA per credit agreement of $45.1 million, an increase of 98.3% year-over-year.

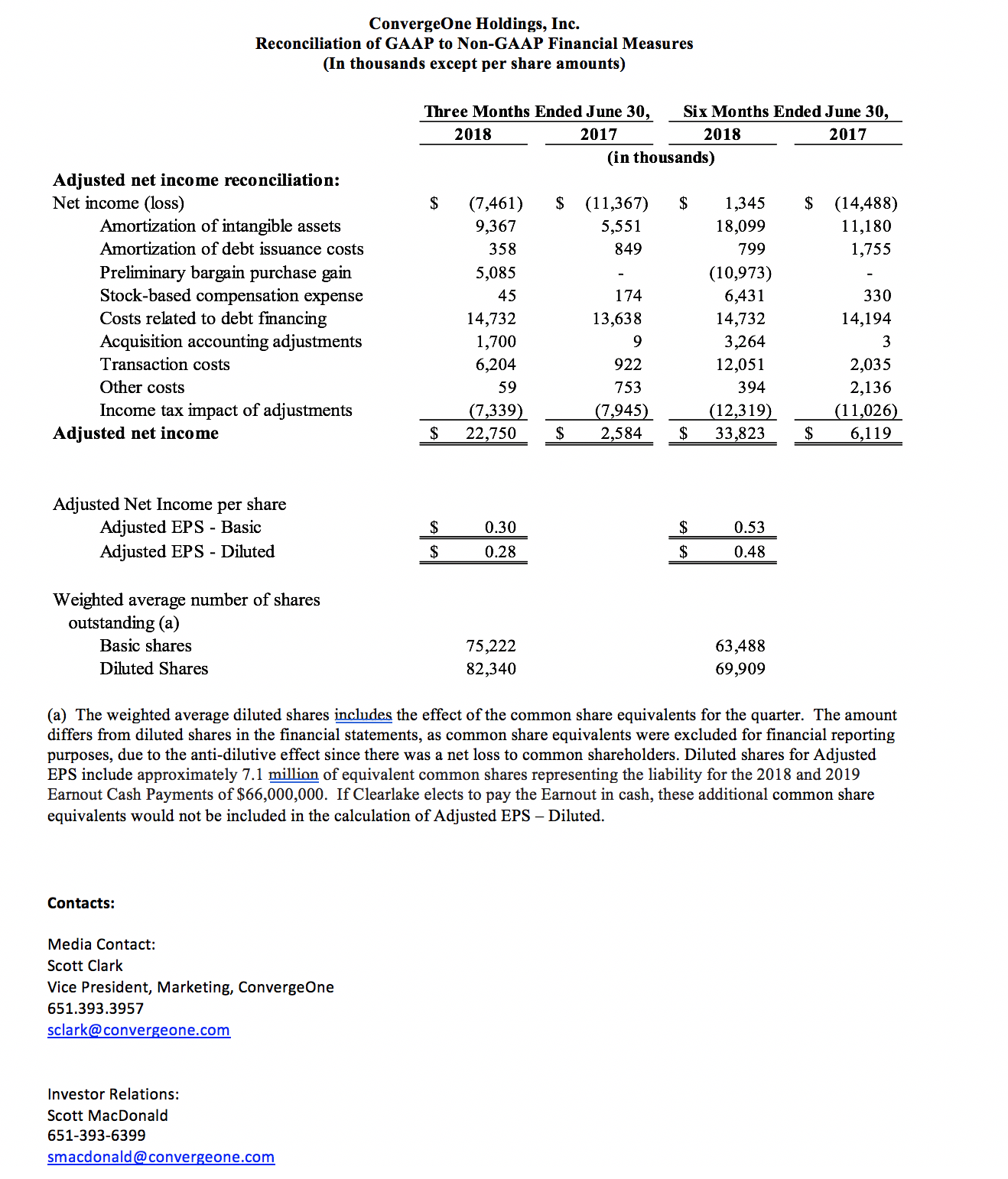

- Adjusted net income of $22.8 million, Adjusted earnings per diluted share (“Adjusted EPS”) of $0.28.

“We are pleased with our second quarter results, which reflect strong execution across the board including robust growth of our Services and Collaboration revenues and ongoing realization of synergies from recent acquisitions,” said John A. McKenna Jr., Chairman and CEO, ConvergeOne. “Our strong first half financial results and momentum in our pipeline and backlog give us increased confidence in our full year outlook. As a result we are reaffirming our 2018 guidance.”

Second Quarter 2018 Financial Results:

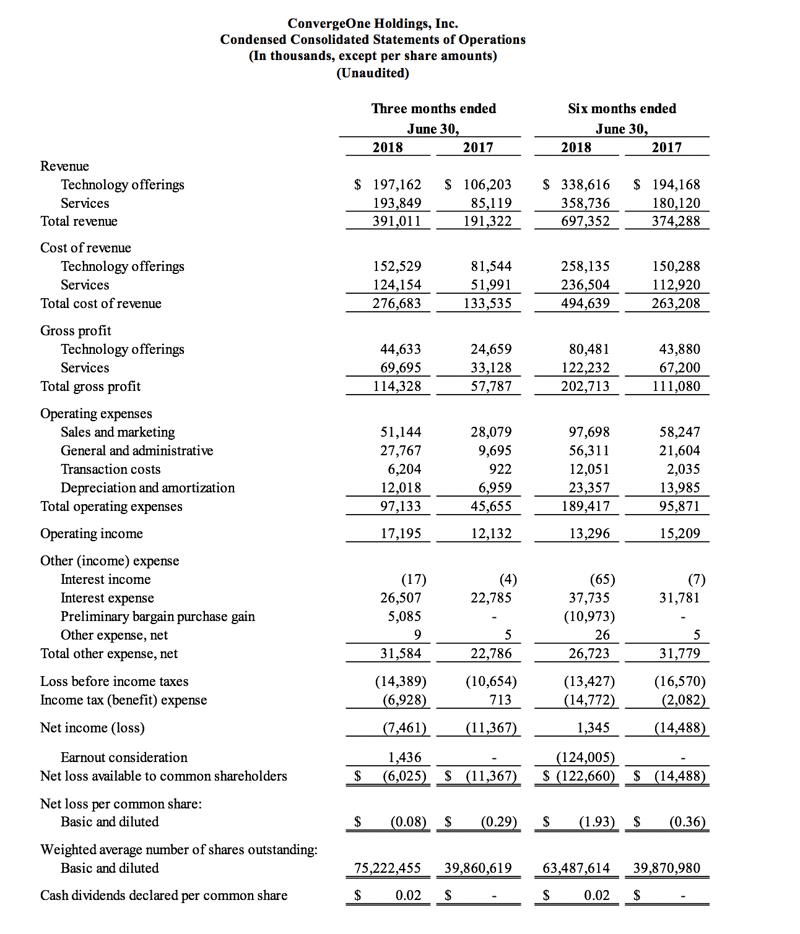

- Total revenue for the quarter ended June 30, 2018 was $391.0 million compared to $191.3 million in the second quarter of 2017.

- Services revenue for the second quarter of 2018 was $193.8 million, an increase of 127.7% compared to $85.1 million in the second quarter of 2017. Services revenue accounted for 49.6% of total revenue compared to 44.5% in the second quarter of 2017.

- Technology Offerings revenue for the second quarter of 2018 was $197.2 million, an increase of 85.6% compared to $106.2 million in the second quarter of 2017.

- Gross Profit for the quarter ended June 30, 2018 was $114.3 million compared to $57.8 million in the second quarter of 2017. Gross margin for the second quarter of 2018 was 29.2% compared to 30.2% for the second quarter of 2017.

- Services gross profit was $69.7 million for the second quarter of 2018, compared to $33.1 million in the second quarter of 2017.

- Technology Offerings gross profit was $44.6 million for the second quarter of 2018, compared to $24.7 million in the second quarter of 2017.

- GAAP net loss was $7.5 million for the quarter ended June 30, 2018, compared to a GAAP net loss of $11.4 million in the second quarter of 2017. GAAP net loss to common shareholders, including the presentation effect of $(1.4) million of earnout consideration related to compensation expense for earnings per share purposes, was $6.0 million for the quarter ended June 30, 2018, compared to a GAAP net loss of $11.4 million in the second quarter of 2017. (1) Second quarter 2018 GAAP net loss to common shareholders includes $14.7 million of costs related to the refinancing of the Company’s 2017 Term Loan Agreement, $6.2 million of transaction costs primarily associated with the integration of recent acquisitions and a $5.1 million non-recurring adjustment to the Company’s previously recorded bargain purchase gain on the acquisition of Arrow Electronics’ Systems Integration Business.

- Adjusted EBITDA per credit agreement for the quarter ended June 30, 2018 was $45.1 million, an increase of 98.3% compared to Adjusted EBITDA per credit agreement of $22.7 million in the second quarter of 2017.

- Adjusted net income for the quarter ended June 30, 2018 was $22.8 million, or $0.28 per diluted share based on 82.3 million weighted-average diluted common shares outstanding, compared to $2.6 million in the second quarter of 2017.

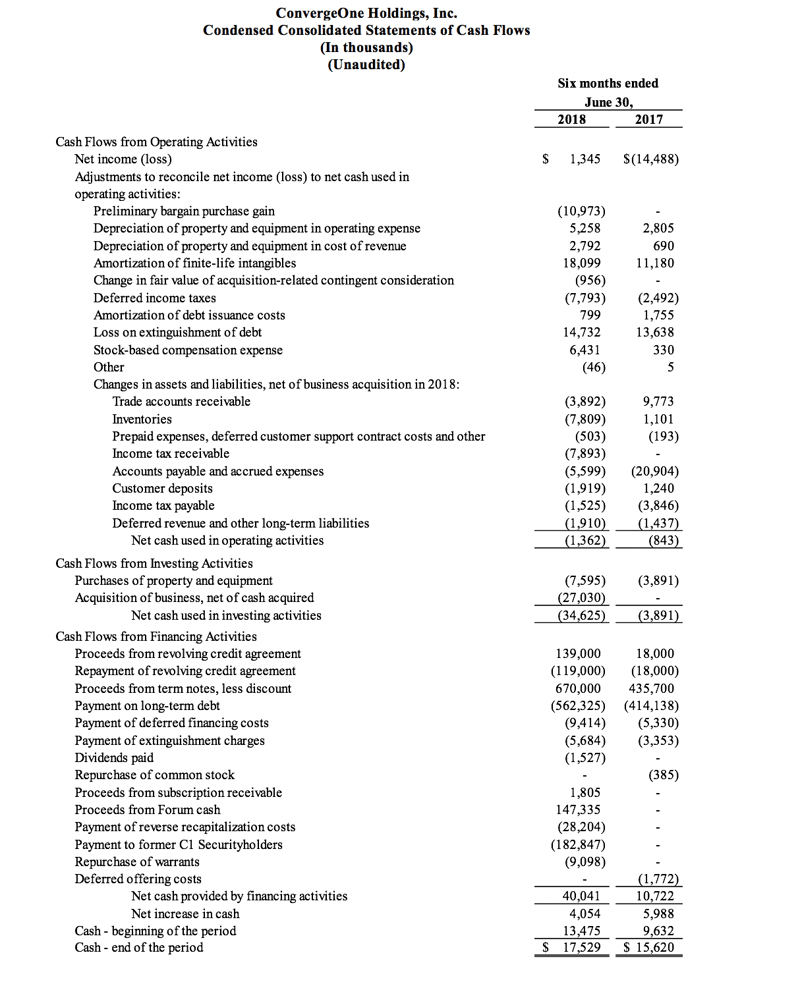

- Net cash used in operating activities for the six months ended June 30, 2018 was $1.4 million, and capital expenditures totaled $7.6 million, compared with cash used in operating activities of $0.8 million and capital expenditures of $3.9 million for the prior year’s period.

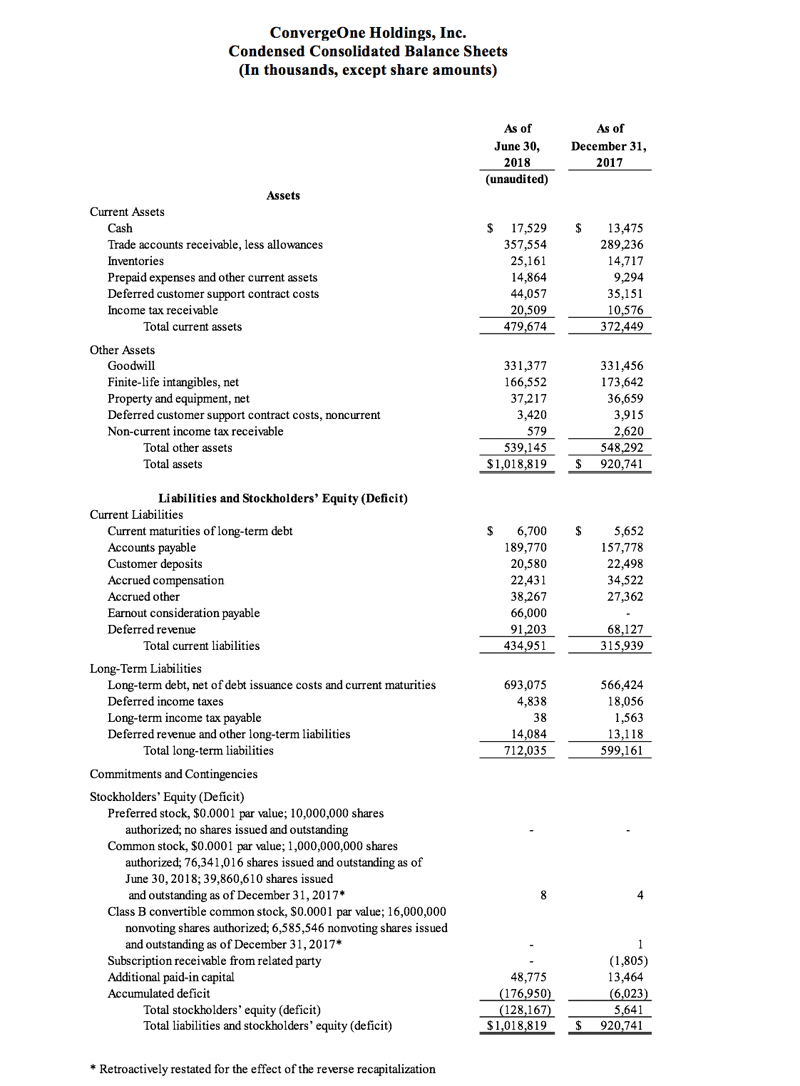

- At June 30, 2018, ConvergeOne had $17.5 million in cash, compared to $13.5 million at the end of 2017. Net of debt issuance costs, total debt outstanding at June 30, 2018 was $699.8 million, compared to $572.1 million at the end of 2017.

Dividend

On August 8, 2018, ConvergeOne’s Board of Directors declared a regular quarterly cash dividend of $0.02 per share to be paid on September 14, 2018 to stockholders of record as of August 24, 2018. ConvergeOne’s Board of Directors anticipates declaring this dividend in future quarters on a regular basis; however, future declarations are subject to Board of Directors' approval and may be adjusted as business needs or market conditions change.

2018 Financial Expectations

ConvergeOne management is reaffirming its full year 2018 financial outlook:

- Revenue is expected to be in the range of $1,450 to $1,550 million.

- Gross profit margin is expected to be in the range of 29.5% to 30.5%.

- Adjusted EBITDA per credit agreement is expected in the range of $155 to $165 million.

- Adjusted Net Income is expected to be in the range of $70 to $78 million.

- Adjusted EPS is expected to be in the range of $0.91 to $1.01 based on 77 million weighted average shares outstanding on a diluted basis.

Earnings Teleconference Information

ConvergeOne will discuss its second quarter 2018 financial results during a teleconference today, August 9, 2018, at 8:00 AM ET. The conference call can be accessed at (866) 777-2509 (domestic) or (412) 317-5413 (international), conference ID# 10122610. A replay of the conference call will be available through 10:00 AM ET August 16, 2018 at (877) 344-7529 (domestic) or (412) 317-0088 (international). The replay passcode is 10122610. The call will also be broadcast simultaneously at https://investor.convergeone.com/. Following the completion of the call, a recorded replay of the webcast will be available on ConvergeOne’s website.

About ConvergeOne

Founded in 1993, ConvergeOne is a leading global IT services provider of collaboration and technology solutions for large and medium enterprises with decades of experience assisting customers to transform their digital infrastructure and realize a return on investment. Over 9,000 enterprise and mid-market customers trust ConvergeOne with collaboration, enterprise networking, data center, cloud and security solutions to achieve business outcomes. Our investments in cloud infrastructure and managed services provide transformational opportunities for customers to achieve financial and operational benefits with leading technologies. ConvergeOne has partnerships with more than 300 global industry leaders, including Avaya, Cisco, IBM, Genesys and Microsoft to customize specific business outcomes. We deliver solutions with a full lifecycle approach including strategy, design and implementation with professional, managed and support services. ConvergeOne holds more than 6,000 technical certifications across hundreds of engineers throughout North America including three Customer Success Centers. More information is available at www.convergeone.com.

Footnotes

(1) In the first quarter of 2018, the Company recorded total estimated earnout consideration of $126.9 million related to the merger of Forum Merger Corporation and ConvergeOne, as the March 31, 2018 last twelve months pro forma EBITDA, as calculated in accordance with the merger agreement, was in excess of $155.0 million, and therefore, the first two tranches of the earnout have been deemed to be achieved. The total earnout consideration was subsequently adjusted to $125.5 million when the Earnout shares were actually issued in May 2018. The earnout consideration was recorded as an equity transaction of $124.0 million and compensation expense of $1.4 million. For accounting presentation purposes, the equity portion of the earnout consideration is reflected as a reduction of the net income available to common shareholders.

Forward Looking Statements

This press release includes "forward-looking statements" regarding ConvergeOne with respect to its financial condition, its results of operations, its intended future capital return and its next quarterly cash dividend; the future impact of momentum in its pipeline and backlog; and its financial outlook for 2018. These forward-looking statements reflect ConvergeOne's current views and information currently available. This information is, where applicable, based on estimates, assumptions and analysis that ConvergeOne believes, as of the date hereof, provide a reasonable basis for the information contained herein. Forward-looking statements can generally be identified by the use of forward-looking words such as "may", "will", "would", "could", "expect", "intend", "plan", "aim", "estimate", "target", "anticipate", "believe", "continue", "objectives", "outlook", "guidance" or other similar words, and include statements regarding ConvergeOne's plans, strategies, objectives, targets and expected financial performance.

These forward-looking statements involve known and unknown risks, uncertainties and other factors, many of which are outside the control of ConvergeOne. These risks, uncertainties, assumptions and other important factors include, but are not limited to: (1) the possibility that ConvergeOne may be adversely affected by economic, business, and/or competitive factors; (2) ConvergeOne's ability to identify and integrate acquisitions and achieve expected synergies and operating efficiencies in connection with acquired businesses; (3) changes in applicable laws or regulations; and (4) other risks and uncertainties indicated from time to time in the reports ConvergeOne files with the Securities and Exchange Commission (“SEC”) including its Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q.

Actual results, performance or achievements may differ materially, and potentially adversely, from any projections and forward-looking statements and the assumptions on which those vary from forward-looking statements are based. There can be no assurance that the data contained herein is reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor of future performance as projected financial information, cost savings, synergies and other information are based on estimates and assumptions that are inherently subject to various significant risks, uncertainties and other factors, many of which are beyond our control. All information herein speaks only as of (1) the date hereof, in the case of information about ConvergeOne, or (2) the date of such information, in the case of information from persons other than ConvergeOne. Except as required under applicable law, ConvergeOne undertakes no duty to update or revise the information contained herein.

Use of Non-GAAP Financial Measures

To supplement the financial measures presented in the Company's press release in accordance with accounting principles generally accepted in the United States ("GAAP"), ConvergeOne also presents the following non-GAAP measures of financial performance: Adjusted EBITDA, Adjusted EBITDA per credit agreement, Adjusted net income, and Adjusted EPS.

A "non-GAAP financial measure" refers to a numerical measure of the Company's historical or future financial performance, financial position, or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP in the Company's financial statements. The Company provides certain non-GAAP measures as additional information relating to its operating results as a complement to results provided in accordance with GAAP and should not be considered a measure of the Company’s liquidity. The non-GAAP financial information presented here should be considered in conjunction with, and not as a substitute for or superior to, the financial information presented in accordance with GAAP. There are significant limitations associated with the use of non-GAAP financial measures. Further, these measures may differ from the non-GAAP information, even where similarly titled, used by other companies and therefore should not be used to compare the Company's performance to that of other companies.

The Company has presented: Adjusted EBITDA, Adjusted EBITDA per credit agreement, Adjusted net income, and Adjusted EPS as non-GAAP financial measures in this press release. The Company defines adjusted EBITDA as net income (loss) plus (a) total depreciation and amortization, (b) interest expense and other, net, and (c) income tax expense, as further adjusted to eliminate non-cash stock-based compensation expense, acquisition accounting adjustments, transaction costs, and other one-time nonrecurring costs. The Company defines Adjusted EBITDA per credit agreement as Adjusted EBITDA plus (a) Board of Directors related expenses (b) one time and non-recurring process and efficiency improvements, (c) pro forma synergies, and (d) EBITDA per acquisition. The Company defines Adjusted net income as net income (loss) adjusted to exclude (a) amortization of acquisition-related intangible assets, (b) amortization of debt issuance costs, (c) non-cash share-based compensation expense, (d) costs related to debt refinancing, (e) acquisition accounting adjustments, (f) transaction costs, (g) other costs, and (h) the income tax impact associated with the foregoing items. The Company defines Adjusted EPS as Adjusted net income divided by weighted shares outstanding on a diluted basis.

The Company believes the use of non-GAAP financial measures, as a supplement to GAAP measures, is useful to investors in that they eliminate items that are either not part of the Company's core operations or do not require a cash outlay, such as stock-based compensation. ConvergeOne management uses these non-GAAP financial measures when evaluating the Company's operating performance and for internal planning and forecasting purposes. The Company believes that these non-GAAP financial measures help indicate underlying trends in the Company's business, are important in comparing current results with prior period results, and are useful to investors and financial analysts in assessing the Company's operating performance.

The Company has not reconciled its Adjusted EBITDA per credit agreement and Adjusted Net Income 2018 outlook to GAAP net income, or its Adjusted EPS 2018 outlook to GAAP EPS, because the reconciling items between such GAAP and Non-GAAP financial measures cannot be reasonably predicted or accurately forecasted due to the uncertain of timing and the magnitude of the reconciling items, and therefore, is not available without unreasonable effort.

-- Source: ConvergeOne--